July 2025 Newsletter

- bespoke62

- Jul 7, 2025

- 5 min read

Updated: Jul 8, 2025

Watch

The science behind dramatically better

conversations View

Listen

The Game We Can’t Stop

Playing [7 minutes].

We’re not just playing a game with our neighbours anymore. We’re playing it against everyone, everywhere, all the time. Listen

The Bumpy Road to New Highs (2025 Midyear Review)

The halfway point of any year is a good time to pause, reflect, and learn from what we’ve experienced. As we’ve often reminded you, studying the lessons from market history is essential preparation for future challenges.

The first half of 2025 reminded us of the timeless patterns of investing. The more we can internalise these patterns, the more confidently we can say when the next crisis arrives: “It’s never different this time.”

What’s Happened

The first half of 2025 demonstrated a return to normal market volatility. Following exceptional returns in 2023 and 2024, which were accompanied by unusually low volatility, markets reminded us that calm periods never last.

Adding to the generally positive backdrop at the start of the year, inflation (which had been a persistent concern over the last few years) started approaching target levels in most major economies. This removed one major source of uncertainty that had weighed on markets and investor sentiment.

After reaching new highs in February, markets began to decline due to concerns about the valuations of technology companies.

This decline accelerated on April 2nd, when President Trump announced sweeping tariff measures targeting virtually all trading partners. The market’s response was swift and severe. Some markets fell more than 20% from their previous highs, officially entering bear market territory. If you felt unsettled watching the daily news during those weeks, you weren’t alone.

Yet markets began recovering in late April as tariff policies were scaled back. Most global markets are now positive for the year, with many reaching new all-time highs. This is a remarkable turnaround, considering the negative sentiment just 10 weeks ago.

What We’ve Learned

What happened in 2025 was unique, but it reminded us of timeless investment truths. Three lessons stand out:

1. Markets often overreact to headlines.

The tariff announcement on “Liberation Day” sent markets into a tailspin, only for much of the policy to be scaled back within weeks. This reminded us that markets are composed of people, and people tend to react emotionally to alarming headlines. The initial panic, followed by swift recovery, showed how sentiment can swing wildly while the underlying fundamentals remain largely unchanged.

2. Market timing remains impossible.

The first half of 2025 demonstrated once again that the only way to earn the market’s full return has been to remain invested at all times. During the depths of the decline, many experts predicted further falls and advised caution. Yet the recovery began precisely when fear was at its peak. Did you feel tempted to make portfolio changes during those uncertain weeks? Those who tried to avoid the volatility not only locked in losses but also missed the subsequent recovery.

3. Volatility is a normal part of the investment journey. Make it your friend, not foe.

The correction, followed by a strong recovery, reminded us that volatility isn’t a bug in the system; it’s a feature. These temporary declines are precisely what allow

long-term investors to earn superior returns. Instead of fearing volatility, mature investors understand it’s the price of admission for owning the great companies of the world.

Looking Ahead

As we enter the second half of 2025, we anticipate new challenges ahead. History shows us that the future remains a chain of constant surprises, and we expect this pattern to continue.

The volatility of the first half reminds us that market corrections occur roughly once a year, and investors should not be surprised when markets do what they have always done.

Whether it’s trade tensions, geopolitical problems, or something completely unexpected, we will face them with the same core beliefs that guided us through the first half: patience, discipline, and focus on the long term. Remember, lifetime investment success comes from acting continuously on your plan, not from reacting to current events.

We understand that staying disciplined during volatile periods can be challenging. However, it’s a privilege to support you through these unavoidable challenges, knowing that every cycle you navigate successfully brings you closer to your long-term financial objectives.

Read

The One Realisation That Can Change Everything About Your Finances [8 minutes].

The future we all want begins not with a raise or a windfall but with a decision.

The Real Currency Of Life [4 minutes].

How are you spending your attention?

You Are What You Won’t Do For Money [9 minutes].

You can’t call it a principle unless it has cost you something.

The Joneses Aren’t That Happy [3 minutes].

Finding contentment is probably a better goal than finding happiness.

Why Financial Success Does Not Equal Financial Wellness [4 minutes].

Some people are unhappy even when they succeed.

Why Financial Independence is Overrated [5 minutes].

Many people race toward it without considering the potential consequences.

Rational Optimism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

UK Cancer Survival Rate Doubles Since 1970s

amid “Golden Age”

The proportion of people surviving cancer in the UK has doubled since the 1970s amid a ‘golden age’ of progress in diagnosis and treatment, a report says. Half of those diagnosed will now survive for 10 years or more, up from 24%, according to the first study of 50 years of data on cancer mortality and cases.

Global Extreme Poverty Rate Fell from 2022

to 2025

Global poverty estimates up to 2023 were updated today on the Poverty and Inequality Platform (PIP), including now casted estimates up to 2025. The update includes three main changes to the PIP data.

Tesla Rolls Out Robotaxis in Texas Test

Tesla deployed a small group of self-driving taxis picking up paying passengers on Sunday in Austin, Texas, with CEO Elon Musk announcing the ‘robotaxi launch’ and social-media influencers posting videos of their first rides.

Visuals

Life expectancy is one of the clearest indicators of any country’s quality of life and overall well-being. The world’s average life expectancy, estimated to be around 73 years in 2024, has been increasing steadily, up from 66 years in the year 2000. However, some countries stand out for their exceptional longevity.

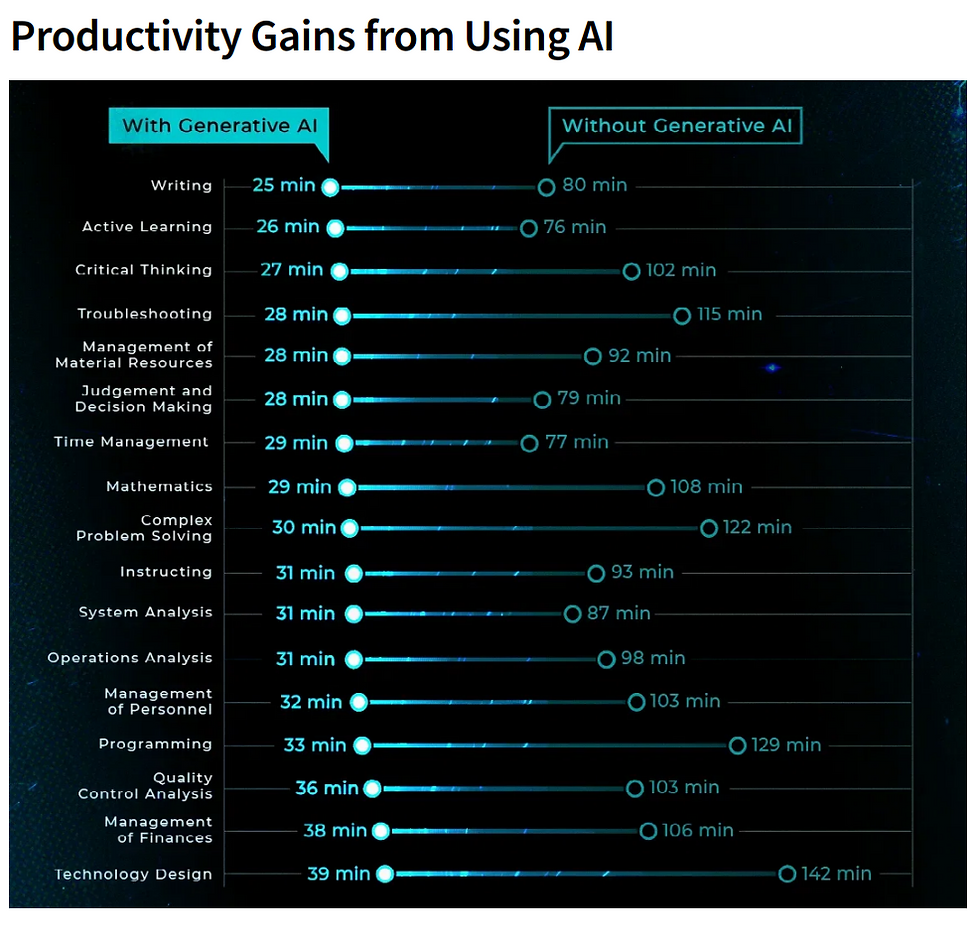

This chart compares the average time (in minutes) it takes U.S. adults to complete 18 common work tasks with and without generative AI tools. The data is based on a December 2024 survey of 4,278 respondents conducted by Stanford University and the World Bank.

The best country in the world is the one you live in. Or… not? This infographic spotlights the 40 countries that the world perceives to be the “best.”

Like most efforts to quantify a qualitative measure, this ranking reflects public perceptions, not hard data. However, countries did have to meet certain GDP, tourism, and FDI thresholds to be included in the race. Data for this infographic is sourced from U.S. News & World Report in partnership with Wharton and WPP. They asked more than 17,000 people to judge 87 nations across 73 attributes grouped in 10 subrankings.

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

As always, we’re here for you. See you next month.

Comments