3% Inflation Could Change Everything

- bespoke62

- Sep 16, 2025

- 5 min read

The South African Reserve Bank’s Monetary Policy Committee (MPC) recently lowered interest rates in line with expectations but commented that they were now aiming for the lower end of the 3-6% target range for CPI, rather than the midpoint of 4.5%, as previously communicated.

The finance minister cautioned against interpreting this as official policy, indicating that a formal agreement between the SARB and Treasury was still needed. Interest rate markets responded well to the news; however, corporate South Africa expressed concern that the apparent misalignment on policy was not ideal for investor confidence.

In May this year, the Reserve Bank released a research study with a central core argument: a fixed 3% inflation target delivers lower macroeconomic volatility, stronger growth, and better inclusivity than the current 3-6% range.

The current range of 3 to 6% is seen as too high and too wide to fulfil the growth ambitions of the economy. A lower inflation target leads to lower structural interest rates and borrowing costs in general, which is positive for growth in the country.

The graph below shows that although South Africa’s current inflation is low and comparable to other developing countries we compete with for business and investment, it has historically been higher and more volatile. This uncertainty dissuades foreign investors from committing new capital to South Africa.

South Africa’s Annual Inflation vs Peer Group (Czech Republic, India, Brazil, Indonesia, Philippines, Vietnam, Malaysia, Mexico)

With the backing of this research study, the new 3% target has been floated. How would a coordinated policy aiming for 3% inflation, rather than 4.5%, impact investors in South Africa?

Two Perspectives

Firstly, the impact on society. In this context, a lower target is beneficial via:

The growth dividend: Potential for ~0.3-0.5% higher annual GDP growth over the medium term from improved stability and lower funding costs.

A fiscal benefit: Lower government borrowing rates could reduce debt-service costs, freeing fiscal space for development priorities.

Inclusivity: Low-income households benefit from reduced price instability, which disproportionately affects essential items.

Secondly, while these macroeconomic effects benefit society overall, for IFAs and their clients, they change the investment return landscape in important ways.

Let's step through what the implications for investments could be:

Lower target inflation tends to drive lower inflation! This may sound obvious, but price-setting ahead of a sales season, for instance, is often linked to what you expect inflation might be. Inflation has a strong element of self-fulfilling prophecy in determining its outcome.

Cash rates fall. Investors need less compensation in interest income if inflation and risks are lower.

Similarly, credit spreads tend to reduce, driven by lower perceived risk.

Government bond yields fall to a new, lower structural level.

The rand should in theory strengthen (or depreciate less or not at all). Although real yields may decline, narrowing the inflation gap with other global currencies could support a stronger and more stable rand.

Company earnings: While there are many moving parts, the easy ones that you can expect are lower nominal returns, similar real returns above CPI, and, at least in theory, a stronger growth base that could improve investment prospects for domestic equity. For example, local banks can often earn more when your home economy is growing as companies seek funding to expand.

Notably, in many of these cases, nominal returns may fall despite real returns remaining relatively stable.

Local investors have enjoyed strong tailwinds compared to global peers, with high bond and cash yields delivering standout returns from traditionally ‘safe assets’. If you’re unsure, consider this: a typical money market fund returned around 8.5% over the past year – well above inflation, which hovered near 3%. That's a 5% real return, compared to the long-term norm of around 1%.

Government bonds have also delivered high returns, partly because markets demand greater compensation for the risk associated with SA government debt. As markets recovered from previous lows, the bond market rewarded investors with a strong 17% annual return to July 2025 – split roughly evenly between income paid and capital growth – driven by a more positive outlook on SA.

Financial Planning Implications

Given these dynamics, and the fact that a lower inflation benefit to society does not necessarily align with higher investment returns, how should we consider the impact on financial planning?

The industry goals of ‘creating, preserving and growing wealth’ all anchor around the cost of inflation eroding this wealth over time and how we can overcome it. Portfolios are then built and financial plans developed around your expectations of inflation. In South Africa, our inflation rate has averaged 5.8% p.a. over the past 30 years, and 5.1% over the past decade. It’s understandable that many investors still assume a 5-6% CPI range when building portfolios or financial plans.

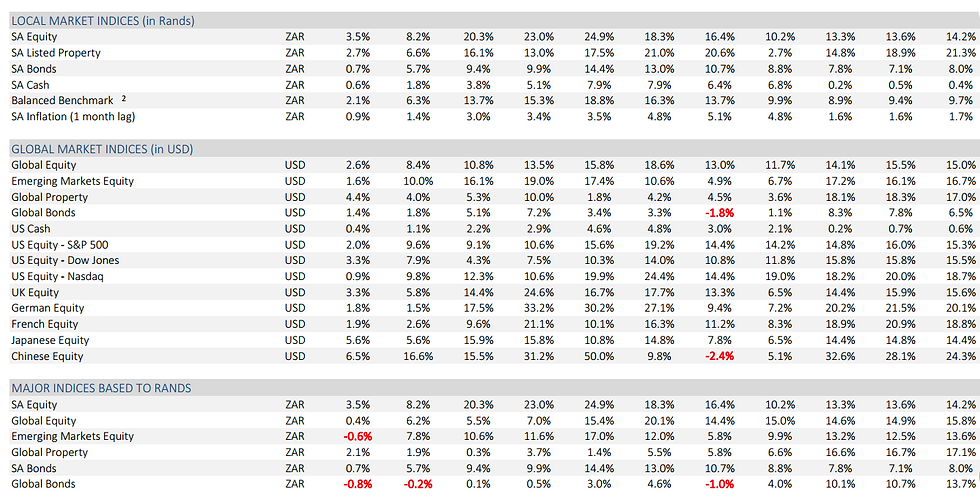

Looking ahead, if SA targets 3% inflation to be competitive among our peers, money market funds may offer 4-5% yields (not 7%), and bonds could settle around 7-8% (rather than 10%). A 7% real return target on SA equities would get you to 10% nominal return (the past 50 years have yielded closer to 14% p.a.).

Another important aspect is the currency. Many local investors lean heavily on the expectation of a depreciating currency to boost domestic returns when they hold investments offshore. In the scenario we’re painting above, this free ride is potentially lost, along with a valuable risk management tool.

A long-term average inflation of 3% then could change everything! And portfolios and plans may need to adapt.

Outlook

We are not there yet. The success of this prospective change in the CPI target rests on a few things: the ‘social compact’ needed to align government, labour, and business with lower inflation and wage growth rates; and the structural reforms needed in government and policy.

Broadly speaking, the SARB has limitations on what it can control with respect to the target. These are the main areas:

External drivers such as the rand level or oil price are influenced as much by other economies as by domestic factors. SARB has limited control here, though maintaining a more stable rand helps.

Administered prices like electricity, water, education, etc. are partially controlled by the government but require significant attention and good management to maintain lower costs in future. This component is estimated at 15-20% of the CPI basket and is running at around double the CPI average.

Inflation expectations are shaped by households, businesses and markets. SARB cannot control them directly but seeks to anchor them through consistent policy action and communication.

Fiscal and structural policies are within government control and play a major role in long-term inflation dynamics.

So, for now, the policy seems to have merit and broad market buy-in, but the ability to execute looks unlikely in the near term. There are structural reasons to expect inflation to remain elevated for now. It would be unwise to push too hard at this point, and any policy misstep may be punished by markets. Still, expectations are beginning to form, and around that likely anchor, we may start to see inflation expectations drift lower. With the Treasury’s backing, we could be entering a new era of monetary policy and fiscal management.

[1] Less risk and more reward: revising South Africa’s inflation target - Christopher Loewald, Rudi Steinbach and Jeffrey Rakgalakane

Market Report

31 08 2025

Key

Comments